Mortgage Blog

Mortgage It Right!

Facing foreclosure? Looking to buy properties under foreclosure? We make the transactions as hassle-free as possible.

July 31, 2014 | Posted by: Kelleway Mortgage Architects

First, what exactly is a Foreclosure?

• According to the Canadian Bar Association a mortgage is a contract to repay a loan, secured with a charge on land.

• In BC, Alberta and other provinces, the charge is registered in the Land Titles Office.

• If a borrower falls behind on his or her mortgage payments, the lender may start to foreclose.

Before the redemption period expires, the borrower needs to either:

1) Bring the mortgage payments up-to-date, OR 2) Pay the mortgage loan in full by refinancing, getting help from family, or selling.

If none of the above happens before the redemption period expires, then the lender can take title to the property or have it sold to collect on the loan.

The Mortgage Borrowers’ View of Foreclosure

Life happens and, for some reason or other, some borrowers fall behind on their mortgage payments.

First question: How much time do the borrowers have to sell their property before it may be lost to the lender?

Second question: How much is a pending foreclosure going to affect the selling price or value of the property?

We calculate your options. Even before contacting a lawyer, borrowers should call us. We have helped many clients with pending foreclosures. One of our first steps is to call the lawyer who is representing the lender! The sooner we are in the loop, the sooner we can explore options for borrower(s) to stop the foreclosure process.

The best case scenario for borrowers facing a foreclosure, is for us to:

1) help the borrowers obtain refinancing,

2) stop the foreclosure process, and then

3) connect the borrowers with a realtor IF the property needs to be sold - ideally, selling it at a higher value than it would have sold through a court ordered sale.

The not-so-great outcome is when borrowers lose their rights to the property and have to move. If that happens, we offer to guide those borrowers towards rebuilding their credit and putting them back on track financially – and, making their life more manageable! Once they are ready to become homeowners again, we can arrange a mortgage and direct them to other trusted professionals who can then help them buy and complete their purchase.

The Real Estate Investors’ View of Foreclosure

An important point for real estate investors to consider is that not all foreclosures are bargains!

Foreclosure properties often need moderate to significant repairs. Most lenders don’t like to approve (even conditionally) a mortgage for properties under foreclosure until after the buyer’s offer is accepted as the winning bid by the court.

Therefore, it can be stressful for those unfamiliar with the process when they encounter difficulties such as:

1) accessing and evaluating the property within deadlines set by the court,

2) obtaining financing, and/or

3) completing extensive property repairs – all in short order!

Before going to court, we educate buyers so that they have a better idea of what to expect. For example, we work with buyers to help them pre-qualify for a mortgage even if they cannot obtain a lender’s pre-approval at that time. Those buyers then have the advantage of going to court equipped with a maximum purchase price in mind. That way, they are more confident that they can qualify for the mortgage they need to complete the purchase.

What to do? Work with us.

We will show you how our experience in this area often arrives at the best financing option possible while easing the stress of all parties involved!

Email: glen@mtgitright.com

(The first time you use this email address, please call first to validate yours. Otherwise, our SPAM filters will block your email and we will not see it.)

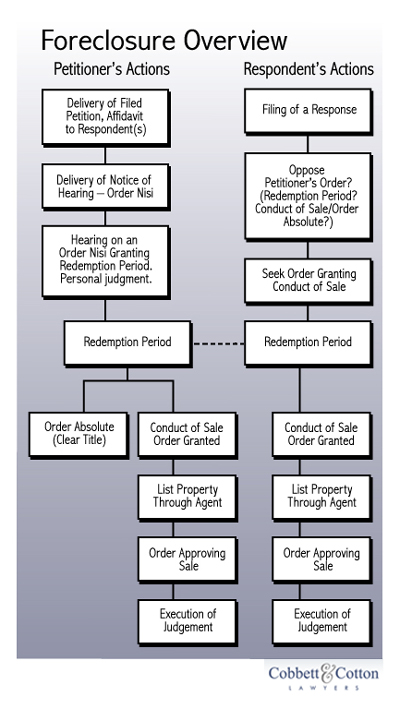

An Easy-to-Understand Flowchart of the Foreclosure Process

Taken from Cobbett & Cotton’s brochure, the flowchart below is an example of a typical foreclosure process for both petitioners and respondents. A crucial deadline to remember is that neither an Order Absolute nor a Conduct of Sale can happen until after the redemption period has expired. The redemption period gives the borrower one last opportunity to stop the foreclosure process by paying any outstanding mortgage payments (and/or property taxes in arrears) and perhaps refinancing. If refinancing fails, the rights to hold the property shift from the borrower to the lender.

Need a Debt Strategy, Plan and Coaching?

Parley Consulting Works for YOU to CREATE a Personal Debt Strategy and Game Plan and then COACHES You to Outplay the DEBT Monster!

Some common debt turnaround solutions include:

• Making a feasible budget – pay the debt in full (or learn this before getting into debt!).

• Getting a consolidation loan – will a lender do it? In some cases, yes!

• Credit counselling services – workable for debt not exceeding $10,000 to $15,000.

• Informal Proposals – a service we offer for those with many assets.

• Consumer Proposal – a debt turnaround solution that suits more families than just about any other.

• Bankruptcy – a powerful mechanism that can provide immediate relief for overwhelming stress.

From short online courses to full debt-credit counseling, visit us online at www.parleyconsulting.com

To get started, call:

604-674-3251 in BC

780-722-3000 in Northern AB

403-724-0003 in Southern AB

Mention this ad and receive $125 Off Parley's regular fee of $265 for its Credit Education eCourse.

*This course is recognized by professional associations for members to earn continuing education credits towards AMP (Accredited Mortgage Professionals) and CFP (Canadian Financial Planner) designations.

What's the Next Step for You?

1) Keep us in mind and on hand in case anyone you know runs into the same sort of situaltion.

2) Share this post with your friends and family because you never know when the info could come in handy.

3) Call or Email Us just to connect and get started talking about your plans. (see below)

4) Sign Up for Glen's Perspective newsletter > Click here

Glen Kelleway, BSc, AMP, Senior Mortgage Planner & Owner

If you would like us to contact you by phone or email, please click Contact Us Kelleway Mortgage Architects will get back to you within one business day.

Phone: 604-476-0053

Toll Free within North America: 1-866-476-0053

Email: glen@mtgitright.com

(The first time you use this email address, please call first to validate yours. Otherwise, our SPAM filters will block your email and we will not see it.)

Join us on Facebook: > Click here

A very insightful article from CBC Business News on July 29, 2014:

'The debt stats do seem daunting: The level of household debt relative to disposable income was a near record 163.2 per cent in the first quarter of this year, Statistics Canada says. That means Canadians owe just over $1.63 for every $1 in disposable income they earn in a year.

That can make it tough to whittle away at the $1.1 trillion (that's trillion, with a 't'), that we owe on our mortgages, especially when we have another $507 billion in higher-interest consumer credit debt on top of those mortgages.'

READ THE FULL ATRICLE HERE: http://www.cbc.ca/news/business/paying-off-your-mortgage-faster-can-pay-huge-dividends-1.2719753

Blog Categories

- Main Blog Page

- Alt-A Lending Options (1)

- Announcements (18)

- Builder's Lien Removal (1)

- Community Relations (1)

- COVID-19 and Mortgage Deferral (8)

- Credit & Debt (15)

- Down Payment (2)

- Education and Courses (4)

- Financial Intelligence (17)

- Foreclosures (1)

- Fun Tips (52)

- Home Improvement (2)

- Legal Considerations (2)

- Line of Credit (LOC) (1)

- Mortgage Lenders (2)

- Mortgage Renewals (10)

- Mortgage Trends & Rates (14)

- Mortgage Types (13)

- Moving to Next Home (8)

- My Mortgage Planner App (5)

- Price per Square Foot (1)

- Prize Draw (41)

- Property Types (11)

- Purchase + Improvement (9)

- Qualifying for a Mortgage (14)

- Real Estate Contracts (2)

- Real Estate Market (12)

- Real Estate Taxes (7)

- Recipes & Serena's Tasty Tidbits (5)

- Relocation into Canada (1)

- Selling Your Home (3)

Blog Archives

- July 2022 (1)

- May 2022 (5)

- April 2022 (5)

- March 2022 (5)

- February 2022 (4)

- January 2022 (6)

- December 2021 (5)

- November 2021 (5)

- October 2021 (4)

- September 2021 (4)

- July 2021 (6)

- June 2021 (7)

- May 2021 (4)

- April 2021 (4)

- March 2021 (5)

- February 2021 (4)

- January 2021 (5)

- December 2020 (6)

- November 2020 (4)

- October 2020 (5)

- September 2020 (3)

- August 2020 (2)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (6)

- March 2020 (10)

- February 2020 (5)

- January 2020 (8)

- December 2019 (4)

- November 2019 (6)

- October 2019 (6)

- September 2019 (3)

- August 2019 (4)

- July 2019 (5)

- June 2019 (3)

- May 2019 (5)

- April 2019 (5)

- March 2019 (5)

- February 2019 (8)

- January 2019 (8)

- December 2018 (4)

- November 2018 (7)

- October 2018 (7)

- September 2018 (5)

- August 2018 (5)

- July 2018 (6)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- December 2017 (1)

- February 2017 (2)

- October 2016 (4)

- September 2016 (1)

- August 2016 (6)

- June 2016 (5)

- April 2016 (1)

- March 2016 (4)

- December 2015 (2)

- November 2015 (1)

- June 2015 (5)

- April 2015 (4)

- January 2015 (1)

- December 2014 (1)

- October 2014 (2)

- July 2014 (4)

- April 2014 (1)

- October 2011 (1)